how are property taxes calculated in martin county florida

Base tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Martin County Tax Collector.

Gully Hill Land Agriculture Or Athletic Fields Ag Eats Agriculture Fields Wetland

The estimated tax range reflects an estimate of taxes based on the information provided by the input values.

. Each property is individually t each year and any improvements or additions made to your property may increase its appraised value. When searching by address enter street number and street name only. Your property tax is calculated by first determining the taxable value.

The tax year runs from January 1st to December 31st. The estimated tax range reflects an estimate of taxes based on the information provided by the input values. Online Property Taxes Information At Your Fingertips.

The final millage rates are used to calculate the estimated property tax on the proposed property purchase. Loading Search Enter a name or address or account number etc. Ad Avalara MyLodgeTax applies state and local taxes to your rental bookings automatically.

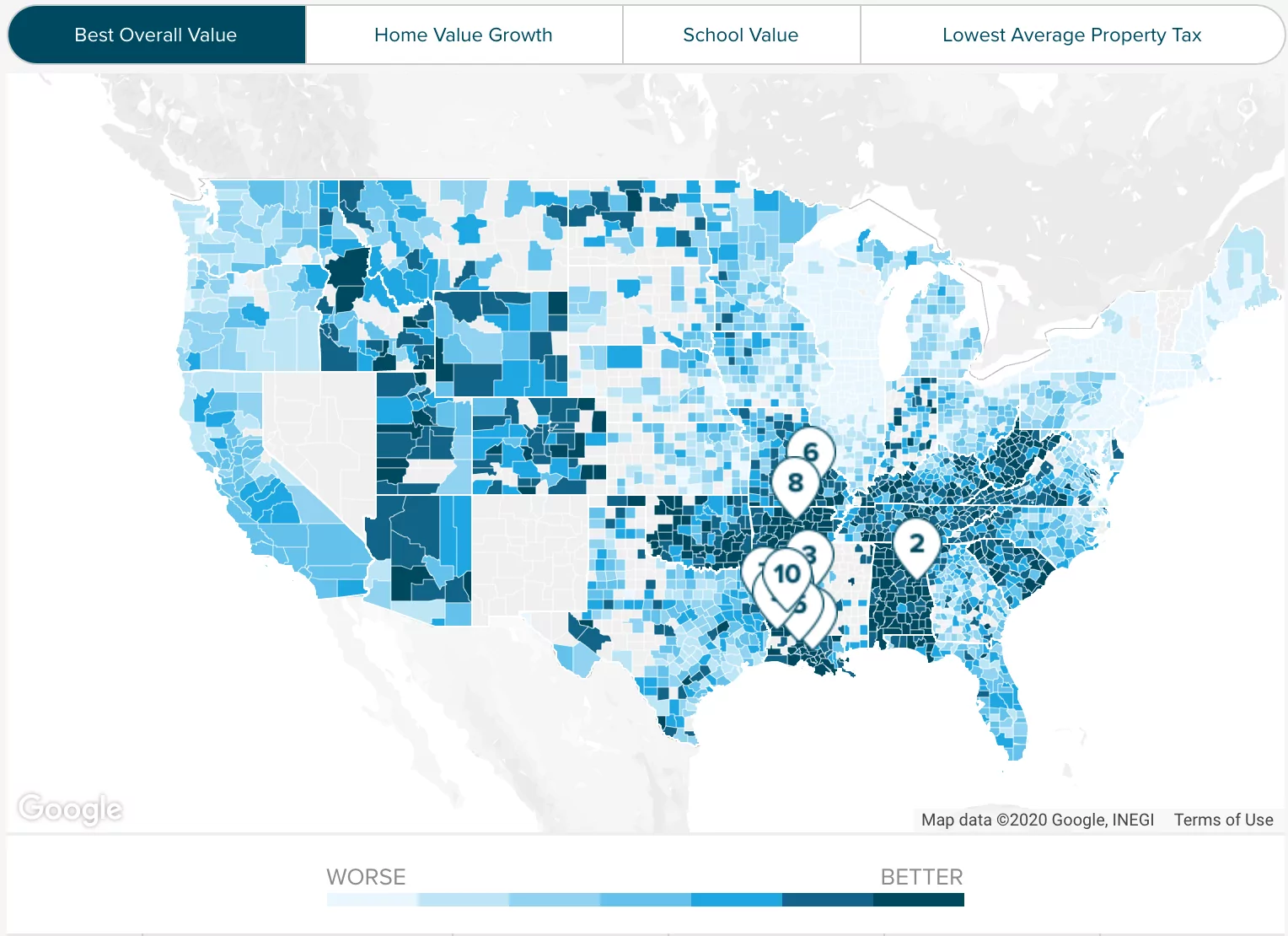

Florida Property Taxes by County. The total of these two taxes equals your annual property tax amount. This interactive table ranks Floridas counties by median property tax in dollars percentage of home value and percentage of median income.

View 2020 Millage Rates. Median property tax is 177300. Ad valorem taxes are added to the non-ad valorem assessments.

The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other taxing authorities set the millage rates. One mil equals 1 for every 1000 of taxable property. Property taxes in Florida are implemented in millage rates.

One mill equals 100 per 100000 of property value. Automate state and local taxes on rental properites so you can focus on guest experience. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes.

The maximum portability benefit that can be transferred is. The maximum portability benefit that can be transferred is. Real Estate Taxes in Florida and How They Are Calculated Palm Beach County and the Treasure Coast Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes.

Enter 555 Main when trying to locate the property at 555 SE Main Street Stuart FL. The median property tax on a 18240000 house is 176928 in Florida. A number of different authorities including counties municipalities school boards and special districts can levy these taxes.

Martin County Assessors Office Services. When buying real estate property you should not assume that property taxes will remain the same. Watching and Protecting Your Tax Dollars For 70 Years.

The taxable value is your assessed value less any exemptions. The median property tax on a 18240000 house is 191520 in the United States. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The final millage rates are used to calculate the estimated property tax on the proposed property purchase. 3473 SE Willoughby Blvd Suite 101 Stuart FL 34994. Florida real property tax rates are implemented in millage rates which is 110 of a percent.

Of the sixty-seven counties in. Please enter the information below for the current tax year to view and pay your bill. The rates are expressed as millages ie the actual rates multiplied by 1000.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. This estimator is based on median property tax values in all of Floridas counties which can vary widely. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value.

There are three major roles involved in administering property taxes - Tax Assessor Property Appraiser and Tax CollectorNote that in some counties one or more of these roles may be held by the same individual or office. Our Martin County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States. Martin County is committed to ensuring website accessibility for people with disabilities.

This equates to 1 in taxes for every 1000 in home value. Martin County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Martin County Supervisor of Elections.

Martin County Taxpayers Association Honors Ruth Pietruszewski. Whenever there is a change in ownership the assessed value of the property may reset to full market value which could result in higher property taxes. Property taxes may be affected with change in ownership.

Real Property records can be found using the Parcel ID Account Number Subdivision Address or Owner Last Name. Enter a name or address or account number etc. The median property tax also known as real estate tax in Martin County is 231500 per year based on a median home value of 25490000 and a median effective property tax rate of 091 of property value.

Martin County calculates the property tax due based on the fair market value of the home or property in question as determined by the Martin County Property Tax Assessor. Ad Property Taxes Info. Martin County Property Appraiser.

Pay for confidential accounts. Combined Tax and Assessment. Florida Department of Revenue.

For a more specific estimate find the calculator for your county. To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the County ADA Coordinator 772 320-3131 Florida Relay 711 or complete our ADA Accessibility Feedback Form. The list is sorted by median property tax in dollars by default.

Ruth Ski Pietruszewski Martin County Tax Collector Meet Ruth America Together 3 Phase Re-Open Plan IMPORTANT CUSTOMER SAFETY PROTOCOLS ARE IN PLACE AT THE MARTIN COUNTY TAX COLLECTORS OFFICE.

Florida Income Tax Calculator Smartasset

Property Tax By County Property Tax Calculator Rethority

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Palm Beach County Fl Property Tax Search And Records Propertyshark

Santa Clara County Ca Property Tax Calculator Smartasset

Get You Refund Florida Income Taxes Free Tax Calculator 2019

Florida Sales Tax Calculator Reverse Sales Dremployee

Your Guide To Prorated Taxes In A Real Estate Transaction

Florida Income Tax Calculator Smartasset

Florida Vehicle Sales Tax Fees Calculator

Property Tax By County Property Tax Calculator Rethority

Santa Clara County Ca Property Tax Calculator Smartasset

Will Nj Get Property Tax Relief From Congress

Florida Property Tax H R Block

How To Calculate Sales Tax Video Lesson Transcript Study Com

Buying A Home Or Condo In Orlando Metro City Realty Buying First Home First Home Buyer Home Buying Process

Property Tax By County Property Tax Calculator Rethority

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro